New allegations against Terra LUNA company founder Do Kwon are being raised. He is said to have withdrawn $2.7 billion before the crash. The coin is now sinking into the ground.

Those users who still believe in the coin should be disappointed by now.

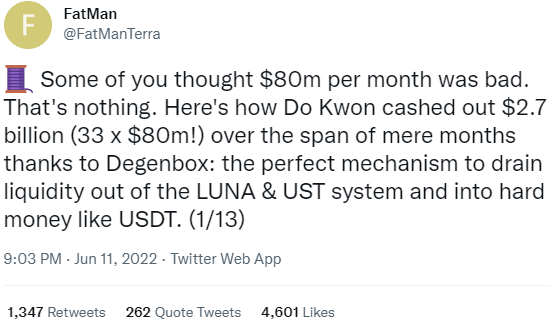

Twitter user FatManTerra accuses Terra Luna company founder Do Kwon of "stealing" a total of $2.7 billion . He was able to carry out this endeavor using a sword box, the user claims. Do Kwon succeeded in doing this by exchanging around 2 billion LUNA tokens for US dollars via detours in the market.

The complex procedure was necessary so that the stablecoin does not lose its connection to the US dollar. As a first step, he exchanged his Luna for UST, the stablecoin Lunas.

Degenbox is a lending exchange on the Abracadabra platform, on which users can in principle borrow almost unlimited UST. The principle works in such a way that users deposit security in order to be able to borrow UST.

This UST can be used to deposit on Anchor Protocol for a 20 percent interest rate. Investors then receive the token aUST, which in turn can be deposited as security. The circle starts over.

FatManTerra argues that this process created the basis for high liquidity in a specific liquidity pool. With thousands of influencers proposing this strategy to their audience , the liquidity in the MIM-UST pool skyrocketed. MIM is Abracadabra's stablecoin.

2.7 billion luna just paid out? Do Kwon gave the coin hold

With this liquidity behind it, it was no longer too difficult for Do Kwon to exchange 2.7 billion UST for MIM. He finally switched this MIM to USDC and USDT. Those centralized stablecoins that Kwon always warned about. touche!

“$558 million went to KuCoin, $1.08 million to Binance, and $545 million to Huobi. Ultimately, the money represents liquidity that the Terra ecosystem is deprived of.”

FatManTerra does not claim Do Kwon caused the crash. He only explains that more liquidity might have prevented the crash. In addition, Do Kwon always claimed to hold his Luna coin and never want to sell it. He himself denies the allegations:

Terra crash shows: Stablecoins are not always so safe

We asked expert Danny Chong, founder of Tranchess, what a perfect stablecoin should look like. On the question of whether this must be algorithmically or 100% collateralised, he explained to us as follows:

“I believe both types of stablecoins can work. For example, a partial coverage could well be successful. But if we look at USDC – it has 100% coverage, which makes perfect sense in this bear market.”

Just recently, Fidelity and JPMorgan invested in USDC, giving the coin a strong and good hedge. “This stablecoin will never collapse because these institutions are always stable,” says Danny. In the current market situation, a fully backed USDC would make the most sense.

Meanwhile, FatManTerra is highlighting issues with USDD, Tron's stablecoin.

The market capitalization of USDD is 723 million US dollars - the corresponding amount was burned (i.e. deposited as cover) in TRX. But since the TRX price has fallen, this sum can no longer correspond to the market capitalization. T he user claims that Tron simply adjusted the numbers so that it is not noticeable.

Stablecoin USDD has made headlines for its sane approach in the wake of the UST collapse. Founder Justin Sun explains the success of the USDD by saying that the blockchain would grow organically. He sees Terra's decay mainly as a result of rapid scaling.

The Luna Coin is valued at $2.39. If this development continues, there won't be much left of Terra Luna 2.0.

Disclaimer

All information contained on our website has been researched to the best of our knowledge and belief. The journalistic contributions are for general information purposes only. Any action taken by the reader based on the information found on our website is entirely at their own risk.

My Top PicksHoneygain - Passive earner that pays in BTC or PayPalMandalaExchange -The Best no KYC crypto Exchange!

BetFury - Play And Earn BFG for daily Bitcoin and ETH dividends!

Pipeflare - Faucet that pays in ZCash and Matic, Games pay in DAIWomplay - Mobile dApp gaming platform that rewards in EOS and BitcoinCointiply - The #1 Crypto Earning SiteLiteCoinPay -The #1 FaucetPay earner for LitecoinLBRY/Odysee - YouTube Alternative that lets you earn Money by viewing videos!FaucetPay - The #1 Microwallet PlatformFREEBTC - The #1 FaucetPay earner for Satoshi'sFaucetCrypto - An earning/faucet site that pays out instantlyFireFaucet - An earning site that pays better for some than Cointiply

DogeFaucet - Dogecoin Faucet

xFaucet - BTC, ETH, LTC, Doge, Dash, Tron, DGB, BCH, BNB, ZEC, FEY - Claim every 5 minutes

Konstantinova - BTC, ETH, LTC, Doge, Dash, Tron, DGB, BNB, ZEC, USDT, FEY, 25 Claims Daily

Comments

Post a Comment