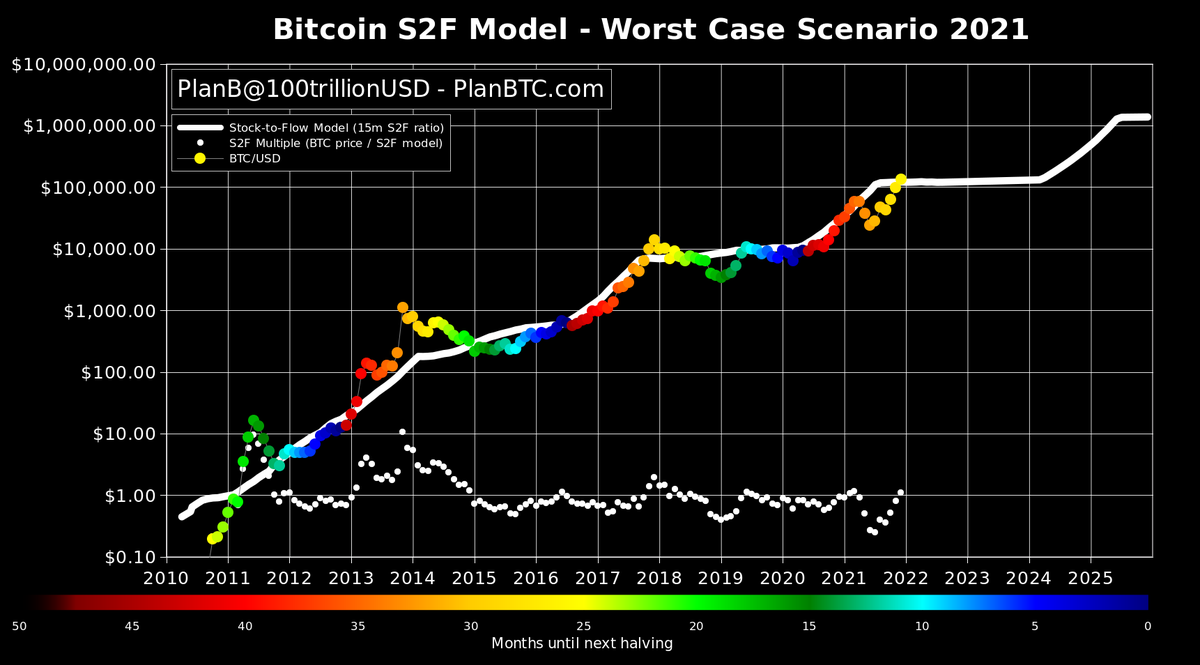

The stock-to-flow model from Twitter user Plan B has long been considered one of the best predictive models for the price development of Bitcoin. The model has proven to be spot on over and over again in recent months. But now it seems to be massively wrong for the first time. Can we still trust the model?

Stock-to-flow model falls far short of the predicted mark

The stock-to-flow model is a Bitcoin price prediction model from the famous Twitter user Plan B. It has over 1.5 million followers and its model has always been alarmingly correct in the past. The model is based on the steadily increasing scarcity of Bitcoin as a result of the Halvings.

In the past, Plan B has predicted the development of the Bitcoin rate with terrifying accuracy. However, he was wrong for November. Because then the Bitcoin should be at $ 98,000 according to the forecast. In fact, the Bitcoin price was around $ 57,000 on November 30th. Then at the beginning of December the new crash occurred.

Plan B: Floor model instead of stock-to-flow model with incorrect forecast

According to the author of the model, many followers misunderstood his statement. Because the $ 98,000 was not a prediction of the stock-to-flow model, but of its floor model. This predicts the minimum price of Bitcoin at a certain point in time. This has always been right in the last few months, but this time it was wrong for the first time.

Because the stock-to-flow model only predicts the average value for the coming cycle. According to the model, this is $ 100,000. Therefore, there is still enough time for the Bitcoin price to level off. The floor model was wrong for the first time, but the arrival of the forecast could simply be postponed.

How credible are the predictions?

Certainly Plan B, with its somewhat opaque communication of its models, did not help the crypto community to keep track of things. This led to confusion and the statement that the stock-to-flow model was now wrong. However, the course can actually continue to level off. The floor model was also wrong for the first time, after having been completely correct dozens of times.

Missing the course targets is not the end of the world. Because every investor who places such high hopes in these models should be clear that nobody can predict the price development of Bitcoin with 100%.

In addition, the discovery of a new Corona variant may have been something like a "Black Swan" - an unexpected event that makes forecasts void. In order to finally assess the credibility of the models, we should wait at least until January 2022.

My Top PicksHoneygain - Passive earner that pays in BTC or PayPalMandalaExchange -The Best no KYC crypto Exchange!

BetFury - Play And Earn BFG for daily Bitcoin and ETH dividends!

Pipeflare - Faucet that pays in ZCash and Matic, Games pay in DAIWomplay - Mobile dApp gaming platform that rewards in EOS and BitcoinCointiply - The #1 Crypto Earning SiteLiteCoinPay -The #1 FaucetPay earner for LitecoinUpland - Collect Digital Properties & Test Your SkillsLBRY/Odysee - YouTube Alternative that lets you earn Money by viewing videos!FaucetPay - The #1 Microwallet PlatformFREEBTC - The #1 FaucetPay earner for Satoshi'sFaucetCrypto - An earning/faucet site that pays out instantlyFireFaucet - An earning site that pays better for some than Cointiply

DogeFaucet - Dogecoin Faucet

xFaucet - BTC, ETH, LTC, Doge, Dash, Tron, DGB, BCH, BNB, ZEC, FEY - Claim every 5 minutes

Konstantinova - BTC, ETH, LTC, Doge, Dash, Tron, DGB, BCH, BNB, ZEC, USDT, FEY, 25 Claims Daily

Comments

Post a Comment